Mortgage calculator how much can i borrow based on salary

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments.

![]()

7 Top Student Loan Calculators That Do Money Saving Math For You Student Loan Hero

Please enter amount here.

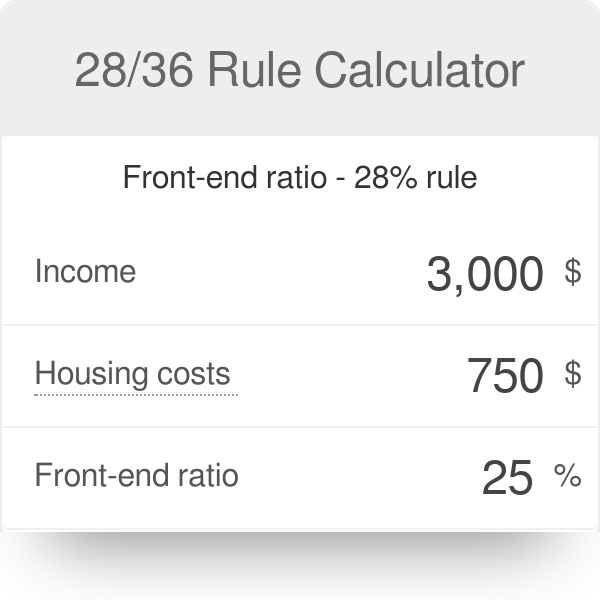

. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. This means you can usually borrow more. Find out How Much You Can Borrow for a Mortgage using our Calculator.

While your personal savings goals or spending habits can impact your. Interest Only ARM Calculator Overview. How Much Can I Afford.

How much can I borrow. To calculate how much house you can afford use the 25 rulenever spend more than 25 of your monthly take-home pay after tax on monthly mortgage payments. This mortgage calculator will show how much you can afford.

To use our mortgage affordability calculator simply enter your and your partners income or your co-applicants income as well as your living costs and debt. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. When it comes to calculating affordability your income debts and down payment are primary factors.

Lets presume you and your spouse have a combined total annual salary of 102200. By the end of the year this is equivalent to 13 monthly payments instead of the usual 12. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home.

Principal interest taxes and. Your 20s are an ideal time to save for the future. That 25 limit includes principal interest property taxes home insurance PMI and dont forget to consider HOA fees.

This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property. Able to borrow based. But ultimately its down to the individual lender to.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. You can gauge how much of a mortgage loan you may qualify for based on your income with our Mortgage Required Income Calculator. Using this method you are splitting your monthly mortgage payments into 26 biweekly payments.

Its never too early to start saving. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Total monthly mortgage payments are typically made up of four components.

Calculate how much house you can afford with our home affordability calculator. 2836 are historical mortgage industry standers which are. In some ways learning your borrowing power is the first step in any serious property search.

If you have a biweekly salary period you can synchronize this with your mortgage payments. How much can I borrow. This strategy takes advantage of the 52-week schedule in the calendar.

Factors that impact affordability. In a buy-to-let mortgage the lender wont work out how much you can afford to borrow based on your income and expenses. It will depend on your Salary Affordability Credit score.

The flipside is that the lending criteria are much stricter. Mortgage calculator UK - find out how much you can borrow. The mortgage calculator on this page can help you estimate your borrowing power using some basic details about your financial situation.

If youre hoping to take out a mortgage our borrowing calculator will give you a rough idea of how much a lender might offer you based on how much you earn and whether youre buying with anyone else. Monthly salary-- The sum of the monthly mortgage monthly tax and other monthly debt payments must be less than 43 of your gross pre. Home buying with a 70K salary.

See the average mortgage loan to income LTI ratio for UK borrowers. If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a. How Much House Can I Afford Based on My Salary.

Having a good idea of what you could buy can make it easier to find an affordable property. Factor in income taxes and more to better understand your ideal loan amount. You can use the above calculator to estimate how much you can borrow based on your salary.

Our home affordability calculator estimates how much home you can afford by considering where you live what your annual income is how much you have saved for a down payment and what your monthly debts or spending looks like. Our affordability calculator can tell you how much you can potentially borrow from a mortgage lender. Theyll look at how much you could earn by renting out the property.

What you can do. How much house can I afford. Based on your salary and deposit we estimate you could buy a property valued up to.

And total mortgage amount that you can afford based on your current financial. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. How to use the mortgage affordability calculator. Simply enter your total household income below and our calculator will do the rest.

Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. 2022 FHA Loan Limits.

FHA calculators let homebuyers and homeowners understand what they can afford to safely borrow to finance a home. Repayments are based on a standard interest rate and principle payment schedule with. The general rule is that you can afford a mortgage that is 2x to 25x your gross income.

Bankrates 401k calculator can help you estimate your retirement earnings. Based on a percentage of the sale price directly impacts your monthly mortgage payment based on a 30-year. You can also input your spouses income if you intend to obtain a joint application for the mortgage.

This calculator provides an estimated amount for illustrative purposes only. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. This is because owning a rental property is risky.

Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home. It is based on the accuracy of the limited financial information provided by you.

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Salary Calculator

Need A Personal Loan Loans For Poor Credit Personal Loans Loans For Bad Credit

Interest Only Mortgage Qualification Calculator Freeandclear

How Much Can I Afford To Borrow Usaa

Good Calculators Online Calculators Tax Finance Hr Mathematics Engineering Online Calculator Mathematics Math Resources

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

How Much House Can I Afford Calculator Money

How Much Can I Borrow Calculator Mortgage Calculators

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

28 36 Rule Calculator

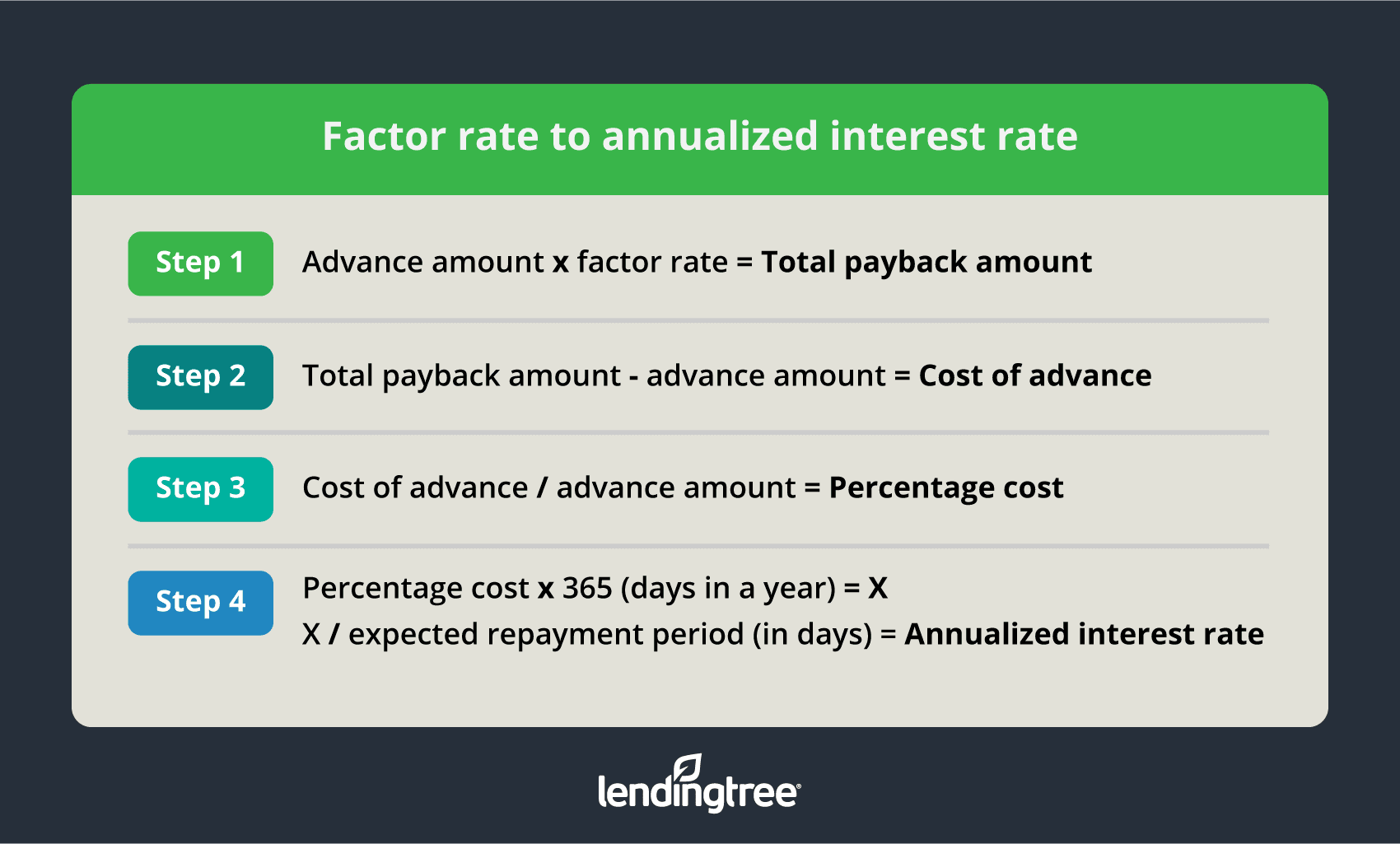

What Is A Factor Rate And How Do You Calculate It

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

Home Affordability Calculator Credit Karma

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement

Komentar

Posting Komentar